The purpose of the Statement of Financial Position/Balance Sheet (SFP/BS) is to report the assets of a company and the composition of the claims against those assets by creditors and investors at a specific point in time. Assets and liabilities come from several sources and are usually separated into current and non-current (IFRS) or long-term (ASPE) categories.

The statement of financial position (balance sheet under ASPE), reports a businesses assets, liabilities and shareholders’ equity at a specific date (at a point in time). This financial statement thus becomes a way for calculating rates of returns on invested assets and for evaluating a business’ capital structure.

The statement of financial position is useful for analyzing a company’s liquidity, solvency and financial flexibility.

Liquidity depends on the amount of time that is expected to pass until an asset is converted to cash or until a liability has to be paid. Solvency reflects an enterprises ability to pay its debt and associated interest. Liquidity and solvency therefore impact the financial flexibility of a company. Financial flexibility considers the ability of a company to take effective actions to alter the amounts and timing of cash flows so it can respond to unexpected needs and opportunities.

IFRS (IAS 1) and ASPE (section 1521) identify the disclosure requirements for SFP/BS, which are quite similar. Listed below are summary points for some of the more commonly required disclosures for both standards:

Below are the basic classifications for some of the more common reporting line items and accounts. The focus is mainly IFRS for simplicity, though ASPE is substantially similar. The required supplemental disclosures below focus on the measurement basis of the various assets, the due dates, interest rates, and security conditions for non-current liabilities; and the structure for each class of share capital in shareholders’ equity when preparing a SFP/BS. These will be discussed in more detail in the chapters that follow in the next intermediate accounting course.

Let’s review some important concepts before looking at specific accounts:

Asset is a resource with economic value that a company owns or controls with the expectation that it will provide a future benefit.

Current assets are those assets that are converted into cash within the operating cycle or one year, whichever is longer.

Monetary assets represent cash or claims to future cash flows that are fixed and determinable in amounts and timing. These assets are either money itself or claims to future cash flows that are fixed or determinable in amount and timing. Examples include accounts or notes receivable.

Nonmonetary assets include assets where measurement is uncertain. Their value, in terms of a monetary units such as dollars, is not fixed. Examples include inventory, property plant and equipment and intangibles.

Property, plant and equipment are tangible, capital assets. These assets last for a longer period, are durable in nature and are used in ongoing business operations to generate income.

Intangible assets are capital (long-term) assets that have no physical substance.

Liability is an enforceable economic burden or obligation.

Current liabilities are those obligations due within one year from the reporting date or the operating cycle, whichever is longer.

Monetary liabilities require future cash flows that are fixed or determinable in amount and timing. Examples include accounts and notes payable as well as long-term debt. (we know the amount of cash to pay).

Long-term liabilities are obligations that are not reasonable expected to be liquidated (paid) within the normal operating cycle but instead are payable as some later date.

| Balance Sheet Template | |

| Current Assets: | Current Liabilities: |

| Cash | Accounts Payable |

| S/T Investments | Accrued Tax, and other Expenses |

| Accounts Receivable | Unearned Revenues |

| Inventory | S/T Loans Payable |

| Prepaid Items | Current Portions of L/T Debt |

| Long Term Assets: | Long Term Liabilities: |

| Noncurrent Investments | Bonds Payable |

| Investments in Shares of other Co. | Notes Payable |

| Investments in Debt of other Co. | Other L/T Debt |

| Bond Sinking Fund | Pension Liabilities |

| Investment in Subsidiary | |

| L/T assets not currently used in | |

| operations | |

| Property Plant and Equipment | Shareholder’s Equity: |

| Land | Contributed Capital: |

| Building | Common Shares |

| Less: Accumulated Depreciation | Preferred Shares |

| Equipment | |

| Less: Accumulated Depreciation | Contributed Surplus |

| Vehicles | |

| Less: Accumulated Depreciation | Retained Earnings |

| Mineral Deposits | |

| Accumulated Other Comprehensive Income | |

| Intangible Assets: | Unrealized AFS gains/losses |

| Goodwill (always kept separate) | Unrealized Hedge gains/losses |

| Copyrights | Foreign Currency Translation |

| Trademarks | gains/losses from Subs |

| Patents | Unrealized gains/losses from |

| Franchises | asset revaluations |

| Licences | |

| Other/Deferred Assets: | |

| L/T Loans to Officers | |

| L/T held for sale assets | |

| Deferred Tax Assets | |

| Offsetting Assets and Liabilities: | |

| Offsetting is allowed only if assets and liabilities are at the same institution | |

| Ex: overdraft at a bank |

SFP/BS – Classifications and Reporting Requirements

| Classification | Report Line Items | Includes | Measurement Bias and Other Required Disclosures at Each Reporting Date |

|---|---|---|---|

| Current assets – assets realized within one year from the reporting date or the operating cycle, whichever is longer. | Cash and cash equivalents (unrestricted) | Currency, coin, bank accounts, petty cash, treasury bills maturing within three months at acquisition. | Fair value, stated in local currency. Restricted cash and compensating balances are reported separately as a current or long-term asset, as appropriate. |

| Investments – trading | Equity investments such as shares purchased to sell within a short time | Usually fair value | |

| Accounts receivable | Trade receivables net of allowance for doubtful account (AFDA) | Net realizable value as a fair value measure | |

| Related party receivables | Amounts owing by related parties | Carrying amount or exchange amount | |

| Notes receivable | Notes receivable within one year | Net realizable value | |

| Inventories | Raw materials, work-in-process, finished goods held for sale, or goods held for resale | Lower of cost and net realizable value (LCNRV) using FIFO, weighted average cost or specific identification | |

| Supplies on hand | Supplies that are expected to be consumed within one year | Usually invoice cost | |

| Prepaid expenses | Cash paid items where the expense is to be incurred within one year of the reporting date | Usually invoice cost | |

| Assets held for sale | Land, buildings, and equipment no longer used to generate income. | If criteria met (ASPE), lower of carrying less costs to sell. | |

| Income taxes receivable | Income taxes receivable based on current taxable loss | Based on tax rate | |

| Deferred income tax assets | Current portion of deferred income taxes avoided/saved arising from differences between accounting income/loss and taxable income/loss | ASPE only |

FVOCI – fair value through OCI (IFRS only)

All else – amortized cost

Measurement basis varies – amortized cost, fair value, discounted present value, estimated construction obligation, and so on

Note that in addition to the measurement basis identified for each asset category in the chart above, many assets’ valuations can be subsequently adjusted, depending on the circumstances. Below are examples of some of the common valuation adjustments made to various asset accounts that will be discussed in later chapters.

| Accounts | Adjustments |

|---|---|

| Cash and cash equivalents | Foreign exchange adjustments for foreign currencies |

| Investments – trading | Adjust to fair values, therefore no subsequent adjustment for impairment |

| Accounts receivable and AFDA | AFDA adjustments at each reporting date are the basis for reporting accounts receivable at NRV |

| Related party receivables | Adjust for impairment |

| Notes receivable | Adjust for impairment |

| Inventory | Adjust for cost of goods sold, shrinkage, obsolescence, damage; reported at lower of cost and net realizable value (LCNRV) |

| Supplies/office supplies | Adjust for usage, shrinkage, obsolescence, damage |

| Assets held for sale | Adjust to fair values, therefore no subsequent adjustment for impairment |

| Investments | Adjust to either fair value or for impairment, depending on classification of investment (refer to classification schedule above for details) |

| Biological assets | Adjust to fair values, therefore no subsequent adjustment for impairment |

| Property, plant, and equipment | Adjust for impairment |

| Intangible assets | Adjust for impairment |

Disclosures such as those listed in the classification schedule above may be presented in parentheses beside the line item within the body of the SFP/BS, if the disclosure is not lengthy. Otherwise, the disclosure is to be included in the notes to the financial statements and cross-referenced to the corresponding line item in the SFP/BS.

Using parentheses tends to be more common for ASPE companies with simpler disclosure requirements. IFRS companies and larger ASPE companies extensively use the cross-referencing method because of the more complex and lengthy notes disclosures required.

Below is an example of a Statement of Financial Position. Recall that a classified SFP/BS reports groupings of similar line items together as either current or non-current (long-term) assets and liabilities.

| ABC Company Statement of Financial Position December 31, 2020 | |||

|---|---|---|---|

| Assets | |||

| Current assets | |||

| Cash | $250,000 | ||

| Investments (fair value) | |||

| Accounts receivable | $180,000 | ||

| Allowance for doubtful accounts | (2,000) | 178,000 | |

| Note receivable (NRV) | 15,000 | ||

| Inventory (at lower of FIFO cost and NRV) | 500,000 | ||

| Prepaid expenses | 15,000 | ||

| Total current assets | 958,000 | ||

| Long term investments (fair value) | 25,000 | ||

| Property, plant and equipment | |||

| Land | 75,000 | ||

| Building | $325,000 | ||

| Accumulated depreciation | (120,000) | 205,000 | |

| Equipment | 100,000 | ||

| Accumulated depreciation | (66,000) | 34,000 | 314,000 |

| Intangible assets (net of accumulated amortization for $25,000) | 55,000 | ||

| Goodwill | 35,000 | ||

| Total assets | $1,387,000 | ||

| Liabilities and Shareholders’ Equity | |||

| Current liabilities | |||

| Accounts payable | $75,000 | ||

| Accrued interest payable | 15,000 | ||

| Accrued other liabilities | 5,000 | ||

| Income taxes payable | 44,000 | ||

| Unearned revenue | 125,000 | ||

| Total current liabilities | $264,000 | ||

| Long-term bonds payable (20-year 5% bonds, due June 20, 2029) | 200,000 | ||

| Total liabilities | 464,000 | ||

| Shareholders’ equity | |||

| Paid in capital | |||

| Preferred, ($2, cumulative, participating – authorized, 30,000 shares, issued and outstanding, 15,000 shares) | $150,000 | ||

| Common (authorized, 400,000 shares; issued and outstanding 250,000 shares) | 750,000 | ||

| Contributed surplus | 15,000 | 915,000 | |

| Retained earnings | 8,000 | 923,000 | |

| Total liabilities and shareholders’ equity | $1,387,000 | ||

Note that the measurement basis disclosures are in parenthesis for any assets where a measurement other than cost is possible. Also note the interest rate and due date parenthetical disclosure for the long-term liability. In the equity section, the class, authorized, and outstanding shares are disclosed.

Taking a closer look at this statement, ASPE Company reports $1,387,000 in total assets and $464,000 in corresponding obligations against those assets owing to suppliers and other creditors.

On the topic of debt reporting, the current portion of long-term debt is a reported as a current liability. The current portion of the long-term debt is the amount of principal that will be paid within one year of the SFP/BS date.

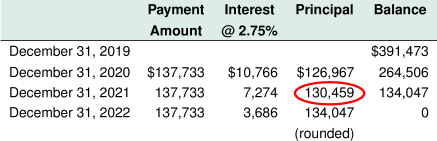

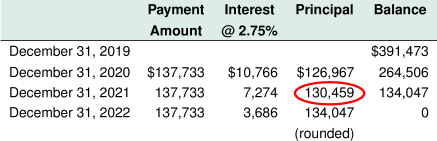

For example, on December 31, 2019, ASPE Company signed a three-year, 2%, note. Payments of $137,733 are payable each December 31. If the market rate was 2.75%, the present value of the note would be $391,473 at the time of signing on December 31, 2019. Below is the payments schedule of the note using the effective interest method.

If the SFP/BS date is December 31, 2020, the current portion of the long-term debt to report as a current liability would be $130,459 from the note payable payments schedule above. Note that this amount comes from the year following the 2020 reporting year to correspond with the principal amount owing within one year of the current reporting date (December 31, 2020). The total amount owing as at December 31, 2020 is $264,506; therefore, the long-term portion of $134,047 would be the amount owing net of the current portion of $130,459. Below is how it would be reported in the SFP/BS at December 31, 2020:

Current Liabilities

Current portion of long-term note payable

Long-term Liabilities

Note payable, 2%, three-year, due date Dec 31, 2022 (balance owing Dec 31, 2020, of $264,506-$130,459)