- repairs (something has broken and needs fixing)

- maintenance (the lawn needs mowing or the trees need pruning)

- costs associated with managing the property (such as agent fees and insurance).

So what exactly are capital expenses?

Anything that increases the value of your rental property and/or extends its life is usually considered a capital expense.

A good rule of thumb is that if you’re:

- adding or installing a new item

- upgrading an appliance or fixture

it will probably be considered a capital expense.

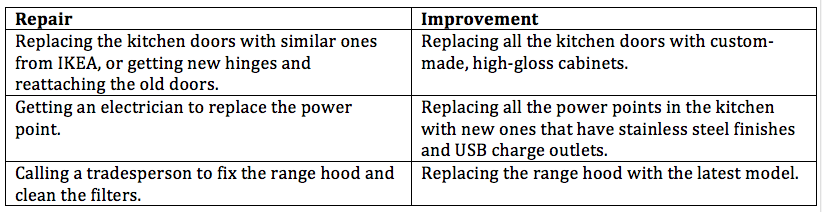

Let’s say there are a few issues with the kitchen in your rental property. A few cupboard doors are broken and have fallen off, a dodgy kettle has damaged one of the power points, and the range hood isn’t working. Here are a couple of ways to solve each problem, and how they would be classified.

Unlike an ongoing expense, you can’t claim a capital expense as an outright deduction (unless it costs less than $300). But you can claim those improvements under depreciation.

How depreciation works

Any improvement you make to your rental property that costs more than $300 (new fixtures or fittings, new appliances, etc.) can’t be claimed as an expense in a single year. Instead, you need to spread it out over multiple years (the ATO will tell you how long). This process is called ‘depreciation of assets based on effective life.’

Generally there are two types of depreciation:

- Appliances and equipment you buy for your rental property (carpets, air conditioners, new range hoods, etc.) These assets are often referred to as ‘plant and equipment’ or ‘fixtures and fittings’.

- Improvements to the building itself—concrete, brickwork, etc. These are often referred to as ‘capital allowances’ or ‘building allowances’, and usually depreciated over 40 years at 2.5% of the original value.

That means you can’t claim the cost of that latest model range hood in one hit. Instead, it needs to be depreciated over the course of its life. Your accountant will work out the percentage you can claim each year using what’s known as a depreciation schedule.

What’s a depreciation schedule?

When you invest in a rental property (or convert your own home into one), you can claim on all of its current assets—even if the property is brand new.

But to do that you need to know what those assets (fixtures, fittings, appliances, etc.) are worth. And that’s where the quantity surveyor comes in. They’ll inspect your property, take notes (not to mention photographs) of everything that can be depreciated, and come up with a depreciation schedule (also known as a depreciation report).

Note: This can’t be done by your accountant, real estate agent or property manager. It can only be done by a qualified quantity surveyor.

According to MCG Quantity Surveyors (who we can certainly recommend if you’ve never used a quantity surveyor before), the best time to get a depreciation schedule prepared is immediately after settlement and just before the tenant moves in. They also suggest you get a depreciation schedule done both before and after you complete any renovations.

Once you have your report, you need to keep it on file in case you’re ever audited.

The good news is you can claim the full cost of using a quantity surveyor straight away. (It’s an ongoing expense, remember?)

An example of what you can claim when you buy an investment property.

Let’s say you just bought a two-bedroom unit in Randwick for $850,000. Of course, you would have also had to pay for legal fees, building and pest inspection, stamp duty on the unit, and borrowing costs.

Now, the legal fees, building and pest inspection and stamp duty on the unit form part of the cost base. (We’ll explain what this ‘cost base is in a moment.) So you can’t actually claim any of them while you still own the property. They’ll be taken into account if/when you sell the unit.

However, you can claim the borrowing costs (stamp duty on the mortgage, mortgage insurance, registration of the mortgage, etc.) as an ongoing expense over the first five years. Just make sure you give the initial mortgage contract to your accountant so they can include these borrowing costs when preparing your return.

I’ve just done some renovations to my new rental property. Can I claim those too?

Unfortunately, there are no hard and fast rules on what you can and can’t claim. It really depends on what you’ve done.

For example, let’s say you buy an investment property that’s a bit run down. Before anyone would even think of living there it needs a new kitchen, new carpets, and a lick of paint. Oh, and the air conditioner needs fixing.

So you install a new kitchen, update the carpets, fix the air conditioner, and hire a painter to give the walls a fresh look.

Now, what can you claim?

Hold your horses. Before you can even think about claiming anything you need to arrange for a quantity surveyor to prepare a depreciation schedule for the:

- new kitchen

- new carpet

- repaired air conditioner

- walls being painted (which will be a building capital work write-off).

Okay, so once that’s done you can start claiming, right?

Yes, the kitchen, carpet, and painting are all capital expenses that can be depreciated over time. And getting the air conditioner repaired would certainly be considered an ongoing expense.

But all of this work was done before the property was available for rent. That means it forms part of the initial property price, and will be depreciated once the property goes on the rental market.

Okay, it’s now a few years down the track, and your tenants (yes, you did get some) have moved out. Unfortunately, they weren’t great tenants. They’ve wrecked the carpets, broken the air conditioning beyond repair, and their smoking habit has ruined the paintwork on the walls. So you need to replace the carpets, give the property a fresh coat of paint, and install a brand new air conditioner.

The good news is your property is now available for rent, which means you can claim the cost of the repairs. Replacing the carpet ‘like for like’ makes it a repair rather than an improvement, and so you can claim it immediately as an ongoing expense. And because the paintwork was damaged by the tenants’ smoking, it’s also classified as a repair you can claim immediately.

Of course, the new air conditioner is considered an improvement, and so will need to be depreciated like any other capital expense.